Project Goal

Whether it’s for a salaried employee, self-employed, or business tycoon, spending money is always easier than earning it. Understanding the flow of your income, spending, and investments is crucial to determine the exact status of your financial health.

Thankfully, we have an option to use fin-tech apps that act as your personal finance manager and keep you updated on expenses and income flow.

One of our clients was looking for a similar B2C solution to facilitate tracking and reporting financial transactions to help individual users from Denmark, Sweden, and United Kingdom manage and track financial health using the robust reporting features.

Solution

After getting hold of what the client expects from the solution, we built his app using Vue.JS for a robust front end and Laravel for impeccable backend features. The goal was to create a feature-packed toolbox to help users get clear, concise, and insightful data about their finances.

Apart from providing an overview of your expenses, income, assets, and liabilities, the app needs to report various perspectives of recorded data to achieve short-term and long-term financial goals.

Let’s go through some of the significant features of our solution to make it a hit right from the start.

The first thing we wanted was to remove the hassle of adding the transactions( income and expenditure) manually to our finance management solution.

We took the help of bank APIs and other available tools to import the transactions from bank accounts, debit cards, and credit cards automatically to generate reports based on data accumulated through it.

The below image demonstrates how easily a user can import the transactions from a bank account with our custom fin-tech solution.

The automatic addition of transactions like expenditures and income is not feasible in all cases. As financial data is often under a high degree of cyber risks, users may avoid adding bank accounts and logging into them to import the transactions.

We provided an easy option where users can add transactions easily by choosing the corresponding source of the transaction in their admin dashboard. Check the below image to know how the manual addition of transactions works on our custom solution.

Robust reporting features are the soul of the solution that we were about to deliver. Unlike the limited reporting options in most budgeting and wealth management apps, we need to take care of users who wish to generate special reports for detailed insights.

Our solution was capable of processing the financial data to come up with reports on:-

- Income statement report to show the distribution of income and expenses.

- 12-month income statement for a yearly overview of income and expenditure.

- Savings ratio and monthly savings to see the income the user actually saves.

- The active and passive report for active and passive income and expenses.

- Financial security report to know passive expenses paid by passive income.

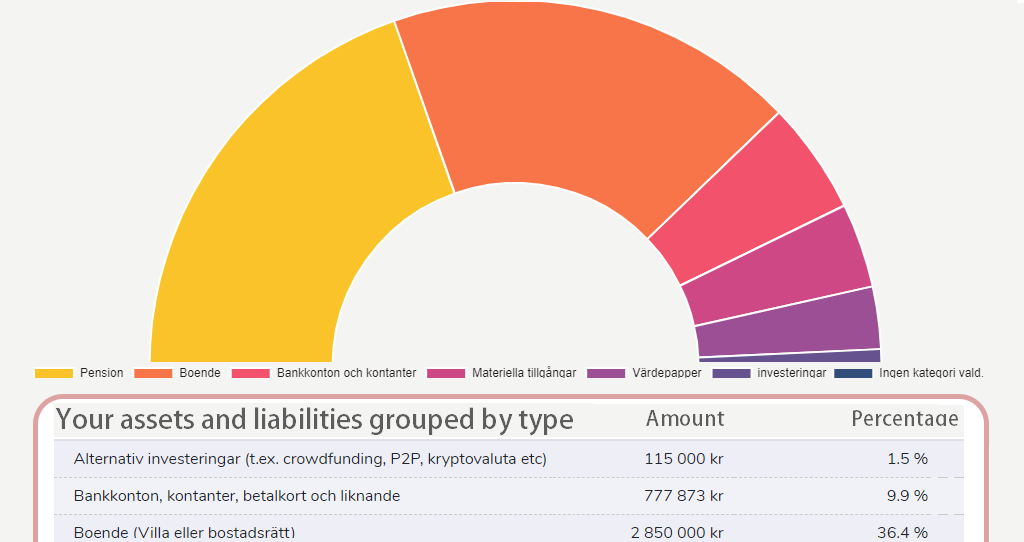

We also added a custom reporting feature that provides a comprehensive balance sheet on assets and liabilities.

This report was meant to help the users to analyze their assets like housing, securities, bank account, and much more. It also helps to analyze the savings from shares, interest, bank accounts, and cash.

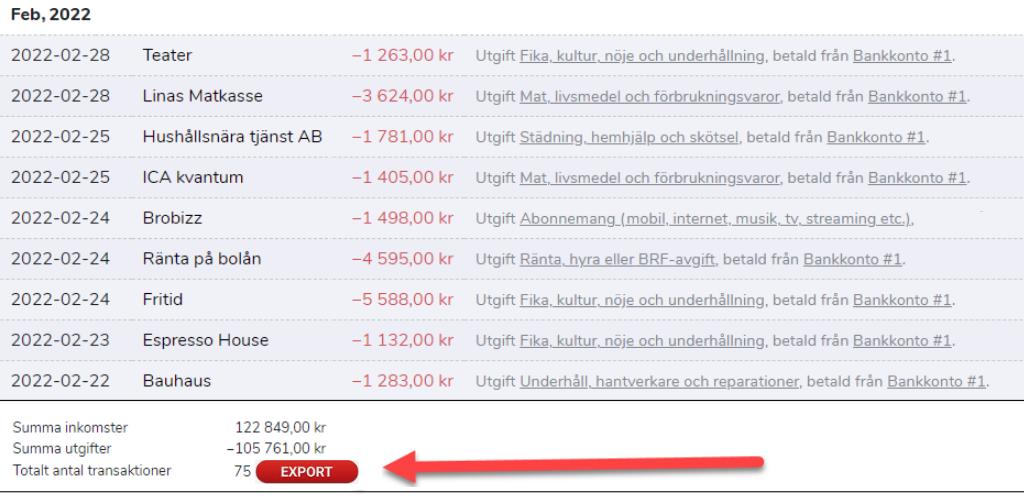

We knew that people prefer the option to export the reports/data in Excel/CSV for further processing. The client doesn’t want the users to copy transaction lists and go through the hassle of arranging data and removing separators.

We provided a simple option to export the data in CSV/Excel format to make that side of the job easy.

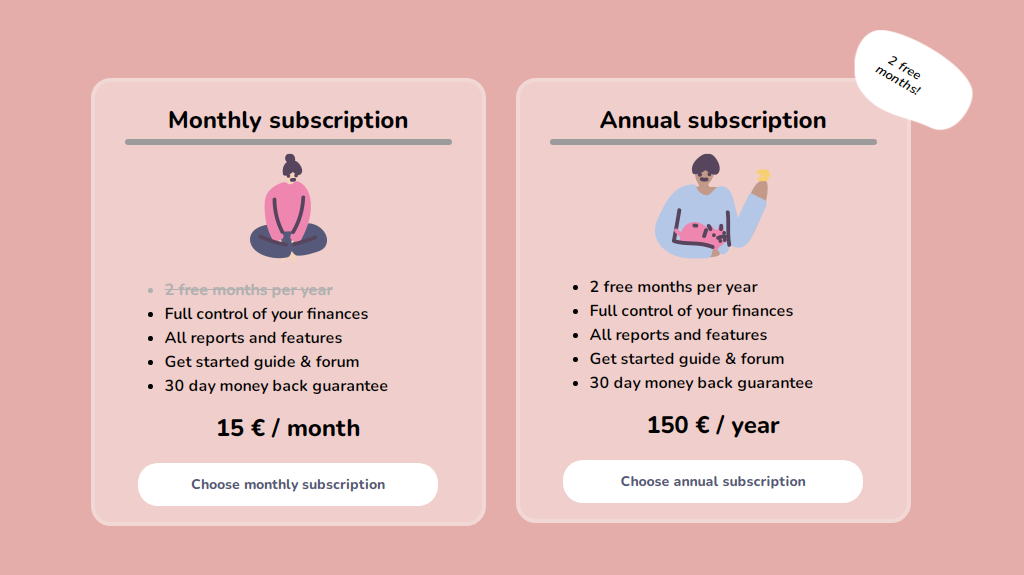

The client was reluctant to offer a free subscription model. He doesn’t want to compromise the utility and user experience of his software by placing ads like most other free apps and software. So we helped him with devising two different subscription plans with tailored features.

Our team integrated the multi-lingual feature that allows users to use the services of our custom fin-tech solution in three different languages. The motive behind doing this was to make the services of our app accessible even for users who don’t speak English.

Our app was capable of serving users speaking English, Swedish as well as Danish language.

Final Words

These were some of the key features that we added to our custom fintech solution for budgeting and wealth management.

Though we faced many technical complications while working on this project, our seasoned developers overcame every obstacle to deliver the fitting solution for the client’s demand.

If you are also planning to build a similar solution, our experts can make it happen while integrating the features and functionalities as per the latest industry standards!

Start your project today

Want to discuss your project with our team? Contact us and fill out your information so our experts can provide you with a free consultation!

Get Started

I want to thank The Brihaspati Infotech team for the fantastic job on my finance management software. They have very high standards and did an incredible job.